Why the Copper Crunch Could Put Small Explorers in the Spotlight

DISSEMINATED ON BEHALF OF COPPER QUEST EXPLORATION AND ZIMTU CAPITAL CORP.

For decades, copper has quietly powered the backbone of modern industry — from wiring in our homes to the grids that deliver electricity. But as the world races toward electrification, copper is stepping into the spotlight. Electric vehicles, renewable power, massive AI-driven data centers, and global infrastructure projects are all converging to drive copper demand to unprecedented heights. Analysts project that global copper consumption could double by 2035¹, a pace the mining sector has never experienced before.

The challenge? Supply isn’t keeping up.

Grades at some of the world’s largest copper mines are falling, new discoveries are scarce, and it often takes over a decade to bring a major project from exploration to production. The result is a looming “copper crunch” — a supply gap that could reshape the entire mining sector.

This is where early-stage explorers like Copper Quest come into focus. Unlike the major producers struggling with depletion, Copper Quest is advancing a portfolio of copper projects in British Columbia — one of the safest and most geologically endowed mining jurisdictions in the world. Their approach is simple but strategic: stake ground in proven copper belts, apply modern exploration techniques, and build the kind of pipeline assets that the majors will one day need.

The Problem: Where Will New Supply Come From?

While demand projections are climbing, copper supply is heading in the opposite direction. The reality is that much of the world’s copper comes from a handful of aging mines in Chile, Peru, and other parts of South America. These operations face a double bind: declining ore grades and increasing political and environmental pressures. In some cases, grades have dropped by nearly half over the past two decades, forcing companies to process far more rock just to produce the same amount of copper.

At the same time, new large-scale copper discoveries are increasingly rare. Most of the world’s major porphyry deposits were found decades ago, and despite billions spent on exploration, very few new Tier 1 deposits have been identified in recent years. Even when discoveries are made, it can take 10 to 15 years to secure permits, financing, and infrastructure before production begins.

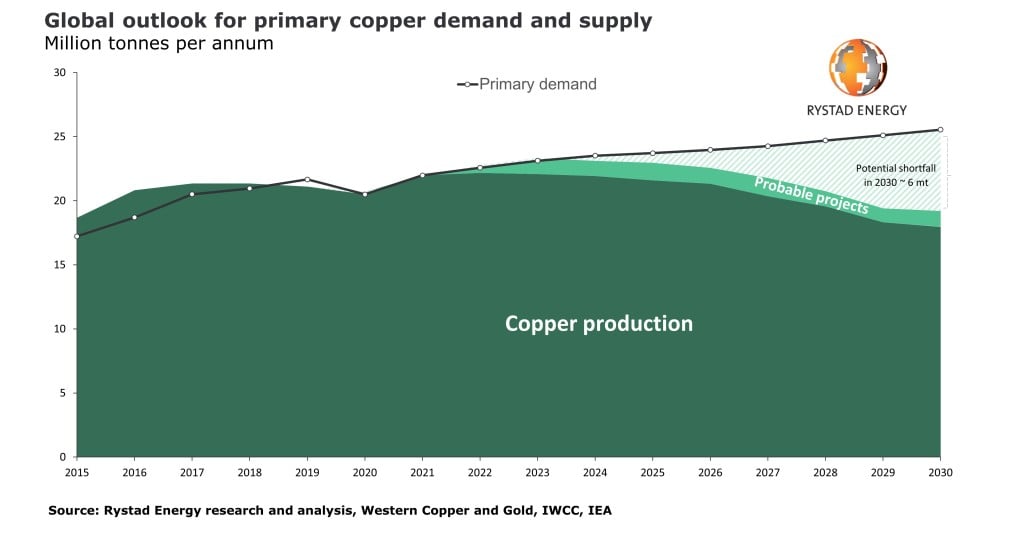

This looming shortfall has industry analysts sounding the alarm. The International Energy Agency (IEA) warns that without a surge in new projects, the world could face a copper deficit of several million tonnes per year by the early 2030s². For investors, this mismatch between supply and demand doesn’t just signal higher prices — it highlights the urgent need for a new generation of projects in stable, mining-friendly jurisdictions.

That’s the backdrop against which Copper Quest is operating. By targeting underexplored copper belts in British Columbia, the company is positioning itself to help fill a gap that could soon dominate the conversation in global resource markets.

The Solution: Early-Stage Explorers in Proven Belts

When the copper supply crunch becomes impossible to ignore, it won’t be the majors alone that step in to solve it. In fact, history shows that many of the world’s largest producers often rely on smaller exploration companies to make the discoveries that eventually become tomorrow’s mines. That’s where early-stage explorers in proven districts come into play.

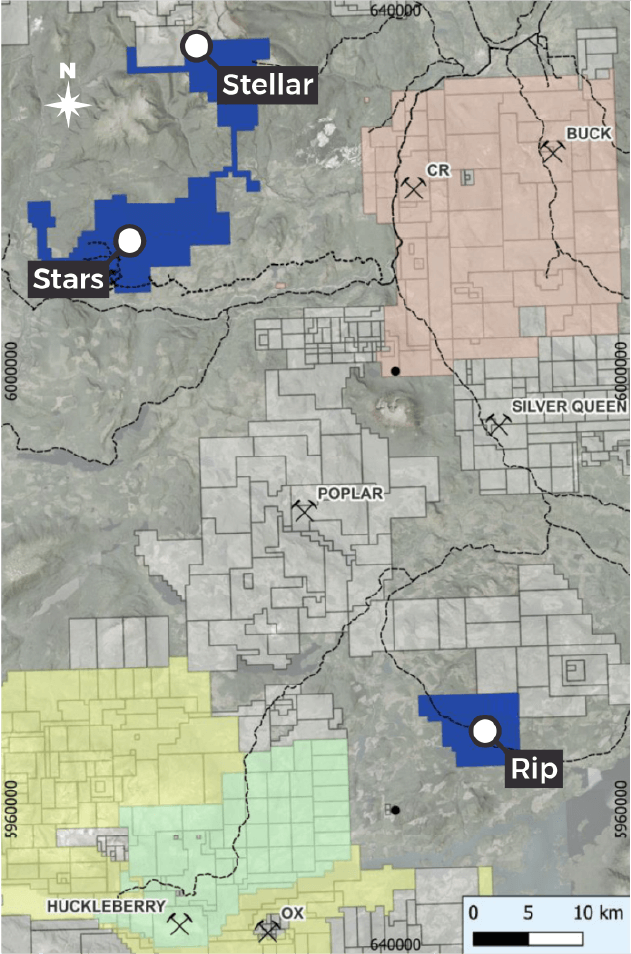

British Columbia has long been recognized as one of the world’s most prolific porphyry copper provinces, hosting mines like Huckleberry, Mount Milligan, and Kemess. The province also offers a critical advantage over many global jurisdictions: political stability, clear permitting frameworks, and established infrastructure that can support new development. It’s no coincidence that some of the most exciting copper exploration activity in Canada today is happening in BC’s Bulkley Porphyry Belt and Toodoggone District.

This is exactly where Copper Quest is focused. The company has assembled a district-scale portfolio that includes:

-

Stars Project – a flagship discovery with drill intercepts of 0.466% Cu over 195 m, an impressive start that has yet to see meaningful follow-up.

-

Rip Project – a 2024 drilling program confirmed the presence of a mineralized porphyry system, with geophysical “donut” signatures pointing to multiple copper-rich centers.

-

Stellar Project – home to the untested Cassiopeia anomaly and historical high-grade showings grading up to 36% Cu and 42 g/t Au.

-

Thane Project – a massive 20,000+ hectare land package with ten copper-gold targets, located between two established mines.

By taking a portfolio approach across these proven copper belts, Copper Quest isn’t betting on a single drill hole. Instead, they are systematically positioning themselves as one of the juniors most likely to feed the pipeline of copper projects needed to close the supply gap.

Copper Quest’s Rip, Stars and Stellar projects in British Columbia

Copper Quest’s Unique Position

What sets Copper Quest apart from the crowd of junior explorers isn’t just the ground they control, but how they’re structured to advance it. With a market cap of only about C$10 million and more than half of the shares held by insiders, directors, and strategic investors, the company maintains a tight capital structure that aligns leadership directly with shareholders. That kind of ownership means management is incentivized to create real value, not just raise money and dilute.

Equally important is the team behind the projects. Copper Quest’s leadership includes veterans with direct experience discovering, financing, and building mines. CEO Brian Thurston brings three decades of exploration experience across porphyry copper systems in BC, Yukon, and Peru. On the advisory side, names like Rich Leveille (former Senior VP of Exploration at Freeport-McMoRan) and Dr. Mark Cruise (founder of Trevali Mining) add global credibility and technical depth. These aren’t just career promoters—they’re people who have taken discoveries all the way to production.

And then there’s geography.

Unlike many explorers chasing high-risk targets in remote or unstable regions, Copper Quest’s assets sit in British Columbia’s proven copper belts, surrounded by infrastructure, past-producing mines, and active majors. Projects like Stars and Rip aren’t isolated greenfield plays—they’re part of districts where copper has already been mined or defined in significant quantities. That dramatically increases the odds of success.

Copper Quest combines a lean capital structure, a discovery-proven team, and district-scale projects in one of the safest mining jurisdictions in the world. It’s a recipe that puts them in a unique position to benefit directly from the copper supply crunch.

The world is heading toward a copper bottleneck. Demand from EVs, clean energy, and infrastructure is climbing, while supply from aging mines is slipping. Majors will eventually need new projects to keep the pipelines flowing, and history shows that it’s often the juniors who make those first critical discoveries.

In a market where timing and positioning are everything, Copper Quest is aiming to be in the right place, at the right time, with the right team. And in the coming copper crunch, that could make all the difference.

References

- S&P Global, “The Future of Copper: Will the looming supply gap short-circuit the energy transition?” (2022). https://cdn.ihsmarkit.com/www/pdf/0722/The-Future-of-Copper_Full-Report_14July2022.pdf

- The Guardian, “Demand for copper to dramatically outstrip supply within decade, IEA warns” (May 21, 2025). https://www.theguardian.com/environment/2025/may/21/copper-supply-demand-analysis-international-energy-agency